Read time: 2 minutes

By: Stephen Stalker

The U.S. drug supply chain is globally fragmented, vastly complex, and contains limitations on the availability and sharing of manufacturing information. As a result, any number of factors along the supply chain can spark a shortage.

The supply of both generic and branded drugs may be interrupted by events in any of three key categories: market-wide supply constraints, product-specific issues, and reimbursement and market access limitations. Within those categories, some of the most common causes of shortages include:

- API issues: Availability of active pharmaceutical ingredients (API) can be impacted by multiple factors including geographic concentration of API manufacturing, changes in testing requirements, and a limited or disrupted supply of key starting materials. The substantial geographic concentration of API manufacturing globally heightens geopolitical supply risk, in particular regions such as China, India, and Eastern Europe. Adequately assessing API risk is difficult for direct purchaser organizations, as crucial information around specific API sources for many products is considered proprietary.

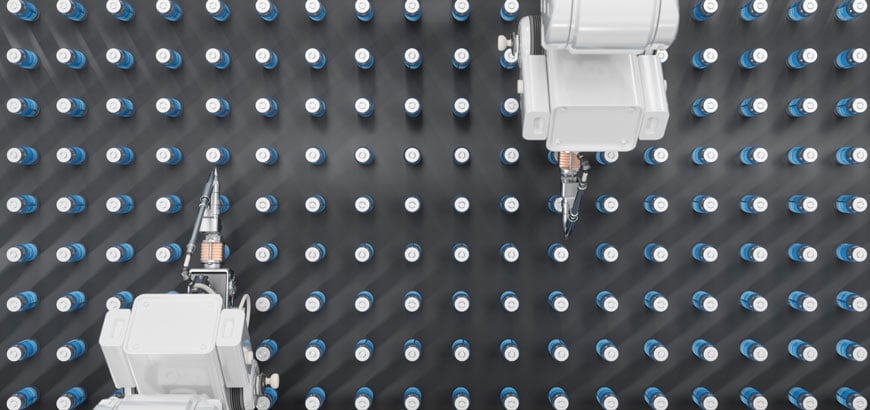

- Manufacturing and quality issues: Manufacturing and quality challenges are among the most common drivers of shortages. Limited production capacity for injectables, highly potent compounds, and complex formulations can impact supply of these products. In addition, quality-related issues such as product recalls due to inadequate manufacturing controls, contaminated raw materials and patient adverse events can cause shortages. Similarly, quality inspections by regulators such as the FDA may lead to Warning Letters or Import Bans that impact product supply. At times, the cost of remediating quality issues can lead to product discontinuations and/or plant closures.

- Generic economic deflation: In aggregate, the generic drug market operates at lower margins. Shrinking profitability on individual products occurs due to declining sell prices, escalating input costs, or inadequate production volumes. Sell prices predominantly reflect the level of competitive intensity (number of competitors and their pricing strategy) and reimbursement. As competitors seek share (and adequate production volumes) in a highly competitive market, the sell price and margin can quickly erode and lead to supplier exits. In markets with limited competitors the supply chain may lack enough redundancy to support unexpected shocks. Maintaining a healthy balance of competition, price, cost, and reimbursement are critical to support a robust supply chain. In addition, Medicaid inflation penalties have limited the ability for generic manufacturers to raise prices, even when other manufacturers have exited the market due to lack of profitability.

- Discontinuing products: Much like generic economic deflation, ongoing product rationalization in the context of a manufacturer’s full product portfolio is simply a fact in the U.S. drug market. Suppliers may eliminate name-brand or generic products from their portfolios altogether or discontinue certain pack sizes, which eliminates some natural redundancy in the supply chain.

- Disasters: When hurricanes, fires or other disasters sweep through an area where drugs or APIs are produced, the effects to the drug supply chain can be devastating. For example, when Hurricane Maria struck Puerto Rico, the powerful storm affected roughly 50 pharmaceutical manufacturing sites, including makers of top-selling biologics and components.

Find more information on McKesson’s strategies for combating drug shortages here, including our comprehensive white paper – Drug Shortages: Root Causes and Recommendation.

Share

Post

Post

Email